Victoria Writers’ Society VWS

Russell Books

February 1, 2023 7pm

So You Want to Be a Writer?—Six Secrets to Success with Edwin Wong

Victoria Writers Society. Friends on Zoom. Good evening! How’s everyone doing? Tonight, I’m sharing with you what I’ve learned since my first book in 2019 to starting my third book. These are tips you can take home with you. This talk is for all of you who have the urge and the nerve to write a book.

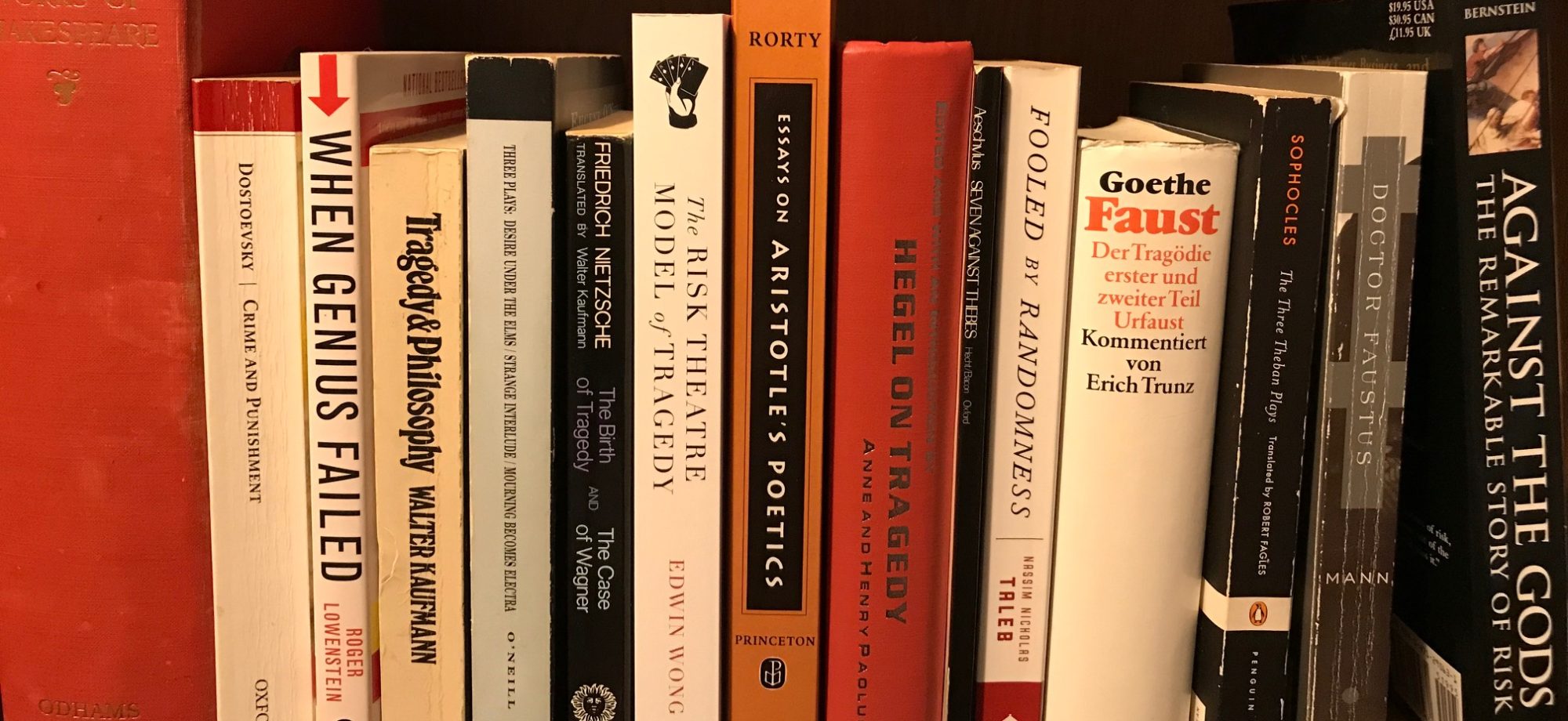

First, a word about what I write about. I write about the intersection between theatre and risk. Macbeth, Oedipus, and low-probability, high-consequence events. Theatre and risk is my gig. My books are how-to books. They inspire writers to write great plays. I just read my friend Michael Poole’s play. It’s called Baldy: Redux. I said, “Damn, Michael, that’s a fine play. Especially the explosive opening.” He replied, “Glad you like it, I rewrote the opening after reading your book.” My books are damn good. Filled with insights on writing. My books will give you a different perspective on theatre. After reading them, you’ll never look at literature, or risk, the same way. Both titles are available right here at Russell Books in the theatre section. Check them out.

Let’s dive into the six secrets to writing success.

It’s a half an hour talk, with questions after. The talk is divided into six five-minute sections. They are:

1) to write, you have to have something to say

2) to write, you have to have patience

3) to write, you have to amuse yourself

4) to write, you have to have a real job

5) to write, you have to handle the criticism

6) to write, you have to write

Point one, to write, you have to have something to say. Lots of people want to become writers. Writing, however, is hard. Harder than people think. Have you heard the joke about the brain surgeon and writer Margaret Atwood? Atwood and the brain surgeon were at a dinner party. The surgeon had just retired, and struck up a conversation with the writer. She asks him, “What will you do now that you’re retired?” He replied, “I’m going to become a writer.” Then he asks Atwood, “What will you do when you retire?” She replied, “I’m going to become a brain surgeon.” The moral of the story is that writing is hard. It’s like picking up a whole new career. So, to write, you have to have something to say. You have to want it bad enough.

My first book took thirteen years. That’s a long time. It’s a big commitment. That’s why, to write a book, you have to have something to say. When you have something to say, your message is concentrated. You need this. For when you become famous. You got to think ahead. You ever heard anyone talking about someone famous saying: “They do this and that.” No. The power of famous writers and famous people is concentrated. It’s “Stephen King, the horror writer.” It’s “Margaret Atwood, the writer of The Handmaid’s Tale.” In my own writing, I stick to the theme of risk in literature. In the last four years, I’ve written two books, a refereed article, and thirteen book chapters all on the same theme. What I find is that this gives me a fighting chance. Einstein, he came up with the Theory of Relativity. Curie, she discovered radium. You have to concentrate your power and focus so that people can find you and talk about you. Even when you concentrate your forces, it’s hard. Just recently, my work on risk got mentioned in a book by TEDx speaker and NYT bestseller Michele Wucker. Unless I had put all my eggs in one basket, it wouldn’t have happened. So, to write, you have to have something to say, and really ONE thing to say. You have to concentrate your forces on the ONE thing you’re passionate about. You got to go big or go home.

Point two: to write, you have to have patience. Ever heard of psychiatrist Carl Jung? He was one of the founders of psychoanalysis. He had something to say. He came up with the theory of synchronicity. Synchronicity is a coincidence that’s so uncanny that it couldn’t have been caused by chance. Instead, it’s the mysterious world of archetypes talking through what appears to be chance. Or so he argued. One time, a reluctant patient who didn’t believe his hocus-pocus was recounting to him a dream about a golden scarab. It just happens, in some mythologies, the scarab is a symbol of rebirth. At that moment, a June beetle, a golden-coloured scarab-like insect, started tapping on the window. Jung opened the window, caught it, and handed it to his patient as she was recalling her dream. “Like this one,” he said. She was astounded. She became a believer. To Jung, the moment marked the patient’s rebirth. What were the odds that, at the moment of the patient’s rebirth, the symbol of rebirth should appear in a dream and at the window? This was a chance that was not chance, but something that proves underlying, more profound connections. Good story, right? Let’s go on.

When I was a kid, I’d hang out at my friend Emily’s house. Her parents had interesting books, one of which was Jung’s Memories, Dreams, and Reflections. In it, he talks about synchronicity. He tells the story about the scarab. When I read it, I thought he just came up with synchronicity then and there. Amazing. What I didn’t know was that it took him decades to get his story right. If you go back to his first conjectures on synchronicity, they’re pretty bad. It took him sixteen years to put together his full-blown theory of synchronicity. He didn’t get it on his first try. Nor on his second. He spent decades figuring out how say it, and never stopped working on it. So, to write, you have to have patience. It takes a long time.

Looking back on my first book, I was writing, but I hadn’t figured out how to say it. I was talking, but wasn’t finding the right words, driving, not knowing where I was going. It wasn’t until some years later in a conversation with playwright Donald Connelly that he gave me the right words. He said to me, “I like your theory of tragedy in which risk becomes the dramatic fulcrum of the action.” I had been saying the same thing, but he expressed in one line “risk is the dramatic fulcrum of the action” what was taking me two or three pages to say. I thought: “Damn! That’s good. I couldn’t have said it better myself.” Like Jung, who took over sixteen years to figure out how to express his ideas on synchronicity, it will take you time to figure out how to say it. Time going on the road. Time going to conferences. Time talking to people. Time getting criticism. Time getting feedback. Many of the essays I’m writing for Salem Press, I’ve been fortunate enough to get great feedback on from Alan. It makes a huge difference. It’s when you get feedback that you see how others see your ideas, and often it’s not the same way you see your own ideas. So, this is point two, to write, you have to have patience. Also, for ideas to catch on, it takes years. Success for writers isn’t measured in months, but in decades. Many times, fame even comes posthumously. I host an international theatre competition called risk theatre (risktheatre.com). It’s in its fifth year and only now starting to gain traction. So, this has been point two: to write, you have to have patience. Fame is a long game.

Point three: to write, you have to amuse yourself. Remember, writing is the long game. To play the long game, you’ve got to keep yourself amused. Here’re some tips to keep yourself entertained. Ever notice in movies, directors often throw in Easter eggs, homages to classic movies? It could be the grain of the film, the sepia tone. The book equivalent is the font. Go through your favourite books. The ones that inspired you. Learn about fonts. Identify the fonts your favourite writers use. Set your book in that font. It’s a nice Easter egg. It’s a nice way to pay homage to your heroes. Both my books are set in Berling, a classic old-face design by Karl Erik Forsberg with generous proportions and slightly inclined serifs. This is the same font Nassim Nicholas Taleb used in his first book, Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets. That’s the book that inspired my theory of literature. Check out fonts. Find a way to amuse yourself and have some fun.

Here’s another one. Ever heard of the boxer Mike Tyson? When he avenged his friend Muhammad Ali’s loss by beating Larry Holmes, he stood over Holmes arms akimbo, with the hands on the hips and elbows turned out. To the crowd, it seemed a spur of the moment thing. But it was a tribute to Battling Nelson, who, in a fight in 1909 knocked out Dick Hyland in the twenty-third round and stood over him in the same pose, as if saying: “This one’s done, who’s next?” To be part of history, you have to recreate history. For those with the eyes to see, Tyson was becoming part of history. It must have been fun practising that pose prior to the fight. Flash forward to today. Ever heard of philosopher Friedrich Nietzsche? Have you seen that old black-and-white profile photo of him? Walter Kaufmann used that photo for the cover of his famous book on Nietzsche. The photo always filled me with wonder. For my third book, I’m recreating that photo. But with myself in Nietzsche’s pose. Cool, right? I love amusing details like this. Get a headshot. You never know when you need it. I’ve been fortunate enough to work with Mike Routliffe (who did the headshot for this event) and just a few days ago, Hollywood photographer Clayton Cooper. There’s some great talent in town.

Have you heard the saying, from boxing, that “You gotta be the champ before you can become the champ?” Writing’s a test of endurance. You have to believe in yourself. One way to increase your endurance and have some fun is to get hypnotized. Has anyone tried hypnotism? I found a hypnotherapist, who, surprisingly was a friend from construction, Harmony Shaw. I called her up and we caught up on old times. Then she asked, “What would you like to come in for, do you need to quit smoking or find a better life balance?” I said, “I need you to hypnotize me to write with bad intentions.” She was like, “What the?!?” I said, “No, listen, I’ve become a writer. I heard that the famous boxing trainer, Cus D’Amato, used to hypnotize his fighters to hit with bad intentions. Well, I want to write with bad intentions.” If she hadn’t of known me, she would have thought I was crazy. But since she did know me, she knew I was crazy.

Here’s how hypnotherapy works. In the first session, the hypnotherapist takes notes of the message you’d like to hear. Then, during the next session, she puts you into that state, you know, either in the morning when you’re awake but not awake or at night as you’re drifting off. It’s an hour session. The hypnotherapist’s goal is to keep you in that dawning or that twilight state. I was skeptical. I went in after a crappy day at work and my mind was far away. But if Cus did it to Tyson, I would do the same thing. She starts. She says: “You hear the clock ticking on the wall. You hear the janitor mopping in the next room.” Pretty soon, I was getting nappy. Then I could hear her saying: “You’ll write with bad intentions. Your words will persevere longer than the pyramids of Egypt. People will write PhDs on your unfinished fragments. Your ideas are as fundamental as the constants of nature.” I remember thinking: “Damn—this is sounding fine!” So she goes on. And then, it comes to an end, but too quickly. After, I said, “Harmony, that was five minutes. I thought it was supposed to be an hour.” She smiled and motioned with her eyes to the clock on the wall. I looked. Then I was amazed. She’s in town, look her up if you want to take your game to the next level and have some fun. Harmony Shaw. Great lady.

We’re still on point three: to write, you have to amuse yourself. Perhaps these boxing anecdotes aren’t doing it for you. Ever heard of the writer Albert Camus? You know, the guy who won a Nobel Prize? Well, he was a skeptic. A rational mind. He didn’t believe in no hocus pocus. But you know what they found in his papers after he died?—I was surprised to learn this. They found an elaborate astrological chart. He had hired an astrologer to cast his chart! But that’s not even the fascinating part. You know what his specific question was? It was: “When shall I achieve literary immortality?” Damn. This one, I haven’t done yet. I’m a skeptic as well. But we’re still on point three: to write, you have to amuse yourself. You have to make it interesting. If anyone knows an astrologer, I need that contact.

Point four: to write, you have to get a job. In 2022, from writing and speaking, I made $5,000. Some years, it’s less. For a long time, I worked as a plumber. For a long time, I hid that. At conferences, I’d be introduced as an “independent scholar.” I hate that term. In the last few years, I’ve introduced myself, at academic conferences, as a plumber. It always gets a few eyebrows. Some take me less seriously. Some take me more seriously. The best comment I’ve had from a proper scholar is that: “I wish I could be doing what you’re doing.” Then I realized not having to worry about tenure and the politics of academia gives me freedom. And a different flavour to my work: I don’t have to put together a massive critical apparatus with footnotes in five languages. People who’ve read my books comment on my hassle-free language and the abundance of construction metaphors. It’s like that because my literary ideas are tested on the job site. Having a job outside of writing gives my writing a unique voice.

Writing is a hard gig. $5000 barely puts food on the table, and $5000, for writing, is a decent achievement. Plumbing, however, is a great gig. It puts food on the table. High school diploma gets you in. You sign up, work ten months of the year, go to school for two months. The government pays for your school and you collect employment insurance (EI) while you’re at school—you’re paid to go to school. At the end of four years, you get your ticket and, with a union outfit, will be making $85k. There are possibilities to advance: shop steward, lead hand, foreman, general supervisor, project manager, estimator. With a high school diploma, you can clear six figures, easy. Plumbing is the biggest thing that’s allowed me to write. I started plumbing 1996. Shout out to those along the way who gave me a chance: Chris Bridgeman, Peter Desaulniers, Tor Hansen, and Gord McClaren. If you’re working a day job, yes you can write. That’s one of the reasons why my first book took thirteen years. A lot of it was written on the bus. I had over an hour commute each way to work. Believe it or not, so that I would have more time to write, instead of taking the 70, which would have been faster, I took the 72, which does the milk run.

What I’m saying, is, to pursue your dreams, it’s good to have a real income. If you have something to say, you’ll find a way.

Point five: to write, you have to handle the criticism. You know dogs, they mark their territory. They whizz a little bit to say, “Hey, this is who I am, this is where I come from, this is mine.” Well, writers are like dogs. Except they don’t whiz on the grass. They whiz on their books. They whiz on every page of their book to say, “Hey, this is mine.” But every so often, another dog comes along and whizzes all over your book. In writer’s talk, we call that a bad review. How do you handle the bad review? Some say not to take it personal. Of course, it’s easy for anyone who’s not getting the bad review to say that! “Oh, you were wearing your heart on your sleeve and someone’s ripped it out, torb it to shreds, and trampled up and down on it? Well, just don’t take it personal.” You ever get that?

In all seriousness, you need the bad reviews: if your book has a hundred five-star reviews, it looks suspicious. You need a few bad ones to make it look legit. Check out these reviews of Donna W. Hurley’s translation of Roman historian Suetonius’ The Caesars on Amazon:

Laurie: five stars “I like this product very much.” [This is pretty meh.]

Jacob G.: five stars “Needed this book for class.” [This is also meh.]

[now check this out] Anna in Texas: one star “Pure Filth! I have to say this is the filthiest book I have ever read my whole entire life and I am 60 years old. If any of this is true then the Caesars were the worst low lives that ever walked the face of the earth. I wanted to know what was happening in Rome during the time of Jesus’ birth, life and death on the cross. I never imagined how bad it must have been, again, if any of this book is true. The reason I question the validity of what Suetonius wrote is that I don’t see how he could have known such detailed information about each of the Caesars and their particular vices. And, even if he did, why write about it? I would not recommend this book to anyone and I am tearing my copy to shreds and throwing it in the trash where it belongs.

Hot damn! That’s the review money can’t buy: it’s just helped you sell a hundred thousand copies. One day, you’ll get some vicious review. Some big dog’s going to come around and whiz all over your book. What do you do? I’m not sure, but here’re some options. 1) ignore. This is professional, if somewhat meh. 2) treat it as a godsend. As the review from Anna in Texas makes clear, there’s no such thing as bad publicity and often the best publicity is bad publicity. 3) fall into a state of depression. This is a tough one, especially if one of your heroes pans your book. It happens. My condolences. 4) write back something witty to the reviewer. One of my friends got a review saying his writing was “worse than imitation crab.” Now, each time he gets a good review, he emails it to that reviewer and writes in the subject line “Better than imitation crab?” I love this. And no, he’s never received a reply back. 5) take it as fuel to write the next great American novel. This is the “Michael Jordan” or “Lance Armstrong” psychopathic approach to criticism.

Here’s a little secret about myself. In a room, I’ve always felt small. You know, some people, they enter the room, and they take over. They got presence. They command the stage. Well, I’m the opposite. In life, no one sees me. A few months ago, we went to Maude’s, I was going to get a round of shots. Trying to get the waitress’s attention, to no avail. Buddy sitting beside me just shook his head. He said: “Ed, no one sees you.” He put up his hand, smiled a golden smile, and the waitress was over lickety-split. I was like, “Damn.” Some people just have it.

In life, I never had it. 150lbs, 5’7” (on a good day 5’7”). But when I’m writing, it’s like I’m 100’ tall. I’m like Napoleon on the plains of France. You know, sometimes life gives you some gifts that confirm what you think you know, but weren’t sure. Well, here’s a story, true story. Last year I was in North Carolina talking about risk at Wake Forest University. After the conference dinner, we were standing around chatting. So, I get introduced to this woman: “Hey, this is Edwin Wong, he directed the play the other night.” She said: “Oh…I’ve read your stuff.” Then she looked me up and down. You know the look. And she said, and I’m not kidding you, “I always thought you’d be taller.” That’s my favourite compliment of all time because it confirms what I always felt when I’m writing. In life I was nothing, but on the page, I’m so much larger than life. That’s why I write. I’m marking out my territory in a way I couldn’t do in life. But what do you do when you’ve marked out your territory and some other dog comes along? Some dogs fight back. Other dogs roll over. I haven’t figured out the answer to this yet. And perhaps there’s no right answer. But it’s something that’s good for us in the writing community to talk about. The bad review is something that’s actually, in a way critical: it wasn’t until after I started getting bad reviews that I actually felt like I was starting to make it.

With that in mind, what’s a talk without some free swag? Here’re some complimentary copies of my book. If you’re interested—and I hope you are—come up afterwards and pick one up. If you don’t enjoy the books, please, do your best impression of Anna from Texas and leave me a review on Goodreads or Amazon. I would appreciate that so much. Any review is great. The worst is the oblivion of no review. Sometimes you get happy reviews. I remember, in 2019, Joy reviewed my book for VWS, it was one of my first reviews and I was so happy to see it.

Point six, last point, short point: to write, you have to write. Sounds simple. But it’s difficult. There’s even a podcast called writingexcuses.com that addresses this point. They end every podcast by saying: “You’re out of excuses, now go write.” Thank you to Elaine Tan for the link. A lot of times, people feel they need to do all this prep before they start writing. I used to be like that. It’s an awful habit. If you start reading great writers, you’ll become attracted into the orbit of their thoughts. And you’ll never break free to find your own voice. To write, all you need to do is to start writing. Push away all those other books. Sounds hard right? But no, it’s really easy. Because we had point one: to write, you have to have something to say. If you have something to say, you’ll find a way. What is it that you’re passionate about, something only you could say? That’s what you write about. And with that, I am finished with what I have to say. If you’ve enjoyed my talk find me on Twitter @TheoryOfTragedy or Facebook at edwinclwong. Thank you.

– – –

Don’t forget me. I’m Edwin Wong and I do Melpomene’s work.

sine memoria nihil