2018, Random House, 279 pages

Book Blurb

From the New York Times bestselling author of The Black Swan, a bold new work that challenges many of our long-held beliefs about risk and reward, politics and religion, finance and personal responsibility.

“Skin in the game means that you do not pay attention to what people say, only to what they do, and to how much of their necks they are putting on the line.”

In his most provocative and practical book yet, one of the foremost thinkers of our time redefines what it means to understand the world, succeed in a profession, contribute to a fair and just society, detect nonsense, and influence others. Citing examples ranging from Hammurabi to Seneca, Antaeus the Giant to Donald Trump, Nassim Nicholas Taleb shows how the willingness to accept one’s own risks is an essential attribute of heroes, saints, and flourishing people in all walks of life.

The phrase “skin in the game” is one we have often heard but rarely stopped to truly dissect. It is the backbone of risk management, but it’s also an astonishingly rich worldview that, as Taleb shows in this book, applies to all aspects of our lives. As Taleb says, “The symmetry of skin in the game is a simple rule that’s necessary for fairness and justice, and the ultimate BS-buster,” and “Never trust anyone who doesn’t have skin in the game. Without it, fools and crooks will benefit, and their mistakes will never come back to haunt them.”

Author Blurb

Nassim Nicholas Taleb spent twenty-one years as a risk taker before becoming a researcher in philosophical, mathematical, and (mostly) practical problems with probability. Although he spends most of his time as a flâneur, meditating in cafés across the planet, he is currently Distinguished Professor at New York University’s Tandon School of Engineering. His books, part of a multivolume collection called Incerto, have been published in thirty-six languages. Taleb has authored more than fifty scholarly papers as backup to Incerto, ranging from international affairs and risk management to statistical physics. Having been described as “a rare mix of courage and erudition” he is widely recognized as the foremost thinker on probability and uncertainty. Taleb lives mostly in New York.

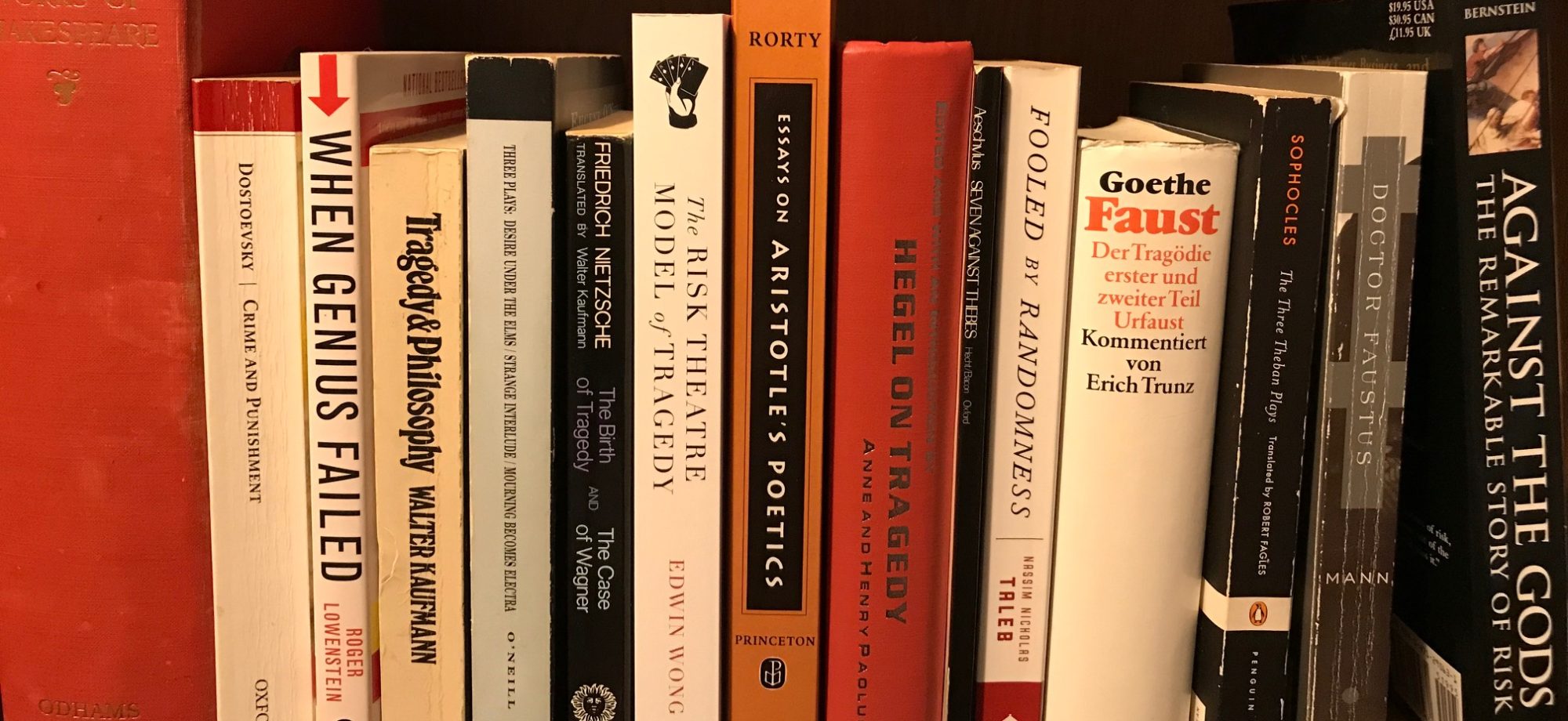

Great Writers Give You Great Ideas

Taleb, as assiduous readers will recall, planted the idea in my mind that a theory of tragedy could be based on risk. While wandering around the big Borders bookstore in Providence Place Mall one evening, his book Fooled by Randomness jumped out at me. Around this time, I had been reading a pile of economics books: A Random Walk Down Wall Street by Malkiel (recommended) and various books by Jeremy Siegel (less recommended). It was at this time I discovered concepts like the efficient market hypothesis and that finance is really quite interesting. There was also a personal reason to learn about investing. My seven year fairy-tale run in academia was coming to an end and it was time to become a civilian again. I still had an investment portfolio that, believe it or not, I had still been adding to while in university (to the tune of $25 or so a month–saving is a hard habit to break). I hadn’t really done anything with it since the Bre-X and Dot Com crash of 1999, but I figured it was time to get back into the game.

1999 was a bad year for investing. My Royal Bank advisor had steered me into tech (it’s the new economy) and precious metals (another hot sector) mutual funds. In addition to exorbitant management fees (round 3% those days), both sectors crashed. Panicked and bummed out, I sold and, by selling, locked in my losses. I lost interest in investing for six years. After which time, I decided if I was going to get back into the game, I would learn how the system worked and do everything myself in a self-directed account. So, I picked up Taleb’s Fooled by Randomness to become a better investor. But the unanticipated outcome was that I would also base a theory of tragedy around the impact of low-probability, high-consequence events. But hey, that’s another story. Back to Taleb.

Hidden Asymmetries in Daily Life

The book’s subtitle is “Hidden Asymmetries in Daily Life.” What does that mean? Taleb’s argument is that symmetrical situations in which risk and reward are balanced are preferable to asymmetrical situations in which rewards can be had without risk. Take, as an example, building a house. The best case scenario is if you build the house yourself because you’re taking on the risk (if could go over budget, the design could be faulty, etc.,) and reaping the potential reward (if it goes well you save a bunch of money). When you take on risk for a shot at a reward, you have skin in the game.

But let’s say you don’t know how to build a house. You’d have to hire a general contractor (GC) to frame the house and look after the plumbers, electricians, glazers, and other subtrades. The good thing is that you have a pro to build your house. The bad thing is that the risks and rewards to your pro are less symmetric: he doesn’t realize the upside. If the house: a) comes in under budget, b) is built to higher standards, or c) is built three months ahead of schedule the GC doesn’t realize the benefits. To him, the risks and rewards are asymmetric. In other words, he doesn’t have as much skin in the game. Taleb’s solution: incentivize the GC with a performance bonus. That way the homeowner and the GC align their risks and rewards. They place their goals on a less asymmetrical and a more symmetrical footing.

That’s the gist of the book: have skin in the game. Talk is talk. Talk is cheap. You have to walk the walk. Don’t ask someone what hot stock to invest in or what their investing philosophy is. Simply see what they have in their portfolio. And beware of asymmetry: if you get advice where you, but not the person giving the advice, is exposed to the harm should the advice fail, run away.

Unsurprisingly, Taleb’s praise is directed to people who have skin in the game. He singles out the Roman emperor Julian the Apostate, who fought in the front lines on the eastern front. In a more recent example of noblesse oblige, during the Falklands War, Prince Andrew also fought on the front ranks, where the danger was the greatest. By taking responsibility for their privilege, they had skin in the game. Martyrs (who die for their beliefs) and businesspeople (who stake their own funds) are further examples of those who have skin in the game. Whistleblowers who face smear campaigns while protecting the public also win Taleb’s praise. In fact, one of the dedicatees of the book is Ralph Nader, who was a victim of an intimidation campaign when he called out General Motors for defective products.

Also unsurprisingly, Taleb’s ire is directed to people who, by gaming asymmetrical situations, profit off the system without putting skin in the game. Journalists, politicians, and academics (especially economists) win his ire. He singles out journalists on BNN or Bloomberg who recommend stocks while they themselves don’t hold positions. The situation is asymmetric because viewers are exposed to harm if the recommendation fails while the journalist gets a paycheque either way.

Taleb singles out politicians who bail out failing institutions: the politicians take the credit for saving the world while it is the taxpayers who fund the bailouts, not the politicians. Taleb devotes significant attention to Bob Rubin, a former Secretary of the United States Treasury. As Secretary of the Treasury under Clinton, Robert Rubin had opposed regulating collateralized debt obligations (CDOs), credit default swaps, and other derivative instruments that Warren Buffett would later refer to as “financial weapons of mass destruction.” After his tenure as Treasury Secretary, he received over $120 million from Citibank, which was rolling in the cash by offering these selfsame derivative financial instruments. But when these derivative instruments led to the 2008 financial crisis and banks needed to be bailed out, the bailout money came out of taxpayers’ pockets, not the pockets of folks like Bob Rubin who had made a fortune by promoting them. To Taleb, this “Bob Rubin Trade” showcases asymmetry: heads I win, tails the taxpayers lose.

Taleb also singles out academics, mainly economists. To Taleb, they come out with fancy economic models and give their models the stamp of approval with their academic credentials. But since academics are divorced from reality (one of his quotes runs: “In the academic world there is no difference between academia and the real world; in the real world there is”) their models seldom work. Economists create asymmetry because real world traders are exposed to harm if they use the economists’ models while economists continue to collect their salaries no matter whether they are right or wrong.

The Lindy Effect

An interesting concept that gains prominence in Skin in the Game is the Lindy effect. The Lindy effect (named after the New York delicatessen where the idea began) states that the longer something survives, the longer it is likely to survive. A Broadway play, for example, that has been playing for 400 days is likely to play for another 400 days. A religion that has been around for a thousand years can be expected to be around for another thousand years. A book that has been in publication for fifty years is likely to be in publication for another fifty years. If, after fifty years it is still in print, then it will likely last another hundred years. If after another hundred years it is still in print, then it will likely survive another 200 years. And so on.

What is the relationship between the Lindy effect and the idea of skin in the game? According to Taleb, concepts and ideologies also have skin in the game. The role of a writer, for example, should not be to please book reviewers (who are not experts and do not have skin in the game) but to please future readers. Time, to Taleb, is the ultimate arbiter. You can fool some of the people today, but if it stands the test of time, it’s legit. Take, say, a fashionable diet, something like the Atkins diet. It’s new, so who knows if it’s good or bad for you. But take fasting days. Many religions have had fasting days for a long, long time. Fast days are “Lindy proof.” They stand the test of time. Because they stand the test of time, they are very likely to be good for you. Consider also coffee (which has been around 600 years) versus today’s latest energy drinks (which have been around a decade). Which do you think will stand the test of time?

I’m not sure about this point, but what I think Taleb is saying with the Lindy effect is this: when you take risk, you have skin in the game, which is good. Risk and volatility is sort of the same thing: if the ride gets too volatile, it’s game over for your endeavour. Volatility and time are also sort of the same thing. So, when you’re taking risks to put skin in the game, you’re actually going one-on-one against time. If you have an idea, to put maximal skin in the game, you want to go against all the other ideas that were and will be out there. It’s a tough game, but there is a reward: the Lindy effect. If you make it to the top, chances are you’ll (or your idea) will stay alive. Not sure if that’s it, but that’s my interpretation of the Lindy effect as it relates to this volume.

Now, this is the fifth volume of Taleb’s Incerto series and it seems with the Lindy effect he’s come full circle. So, the Lindy effect says that something which has survived a long time will likely keep surviving. Unless, of course, this something runs into a black swan. Assiduous readers of Taleb will remember that the second volume of Incerto was called The Black Swan: The Impact of the Highly Improbable. The black swan phenomenon is when highly improbable events happen that change everything. Take the very idea of the black swan. The idea came from the Roman poet Juvenal, who said that “a good person is as rare as a black swan.” The punchline is, of course, that black swans don’t exist. So, for hundreds of years, the phrase “black swan” came to denote something that doesn’t exist. And, what is more, the Lindy effect made the “black swan” analogy more and more prevalent as time went on. Until of course, an actual black swan was sighted in Australia by a Dutch sailer in 1636. So, it was a black swan event (sighting a creature that was not supposed to exist) that brought an end to the Lindy effect on the original use of the term “black swan” as understood by Juvenal. It will be very interesting if, in a future work, Taleb pits these two contrasting phenomena against one another.

Does Risk Theatre Have Skin in the Game?

It’s always interesting to tie the books I’m reading back into what I’m doing. This keeps things real. It gives reading a purpose. Here’s a quote from Skin in the Game that confirmed I was on the right track:

The deprostitutionalization of research will eventually be done as follows. Force people who want to do “research” to do it on their own time, that is, to derive their income from other sources. Sacrifice is necessary. It may seem absurd to brainwashed contemporaries, but Antifragile [the previous title in the Incerto series] documents the outsized historical contributions of the nonprofessional, or, rather, the non-meretricious. For their research to be genuine, they should first have a real-world day job, or at least spend ten years as: lens maker, patent clerk, Mafia operator, professional gambler, postman, prison guard, medical doctor, limo driver, militia member, social security agent, trial lawyer, farmer, restaurant chef, high-volume waiter, fire-fighter (my favorite), lighthouse keeper, etc., while they are building their original ideas.

It is a filtering, nonsense-expurgating mechanism. I have no sympathy for moaning professional researchers. I for my part spent twenty-three years in a full-time, highly demanding, extremely stressful profession [he founded a hedge fund called Empirica Capital, which, coincidentally, bet on black swan declines in the stock markets] while studying, researching, and writing my first three books at night; it lowered (in fact, eliminated) my tolerance for career-building research.

For the last eleven years, I’ve been writing a book: The Risk Theatre Model of Tragedy: Gambling, Drama, and the Unexpected. But, the book was not enough. As Taleb would say, writing the book is like “talking the talk.” Like the Efficient Market Hypothesis, the Black-Scholes equation (for pricing options), and other economic models that Taleb disdains, the risk theatre model of tragedy, while not an economic model, is an academic model nonetheless. As an academic model, it could use some more skin in the game.

To give the risk theatre model of tragedy some more skin, I started up, with Langham Court Theatre, the 2019 Risk Theatre Modern Tragedy Competition. We would award cash prizes to dramatists worldwide to write risk theatre tragedies. We would help these dramatists develop risk theatre to the highest levels by workshopping their plays. And, to help offset travel and accommodation expenses, we’d offer a stipend for dramatists to come attend the workshop in Victoria, Canada.

To fund the book and the competition, I work a real-world job as a project manager for PML Professional Mechanical. I oversee $25 million of construction projects: a mixed use commercial building with Save-on-Foods as the anchor and two residential towers above for Bosa/Axiom, a distinctive condo called the B&W (it’s clad in sections of black and white bricks) for Abstract Developments, and two 20-storey towers for Chard Developments. In other words, I’ve got skin in the game. If Taleb’s thesis is correct, the book and the theatre competition stand a greater chance of success because I’m putting my money where my mouth is. Here’s hoping. Time will tell.

Until next time, I’m Edwin Wong, and I’m doing Melpomene’s work. By the way, this is a great book. Read it. If you haven’t read any volumes in the Incerto series, and are looking for a place to start, you couldn’t go wrong with the second volume, The Black Swan.