Why Passive Income?

The question of passive income came up while driving along Dallas Road with talented business owner EA. We had been catching up. In the last few years, she.s been working hard to expand her startup company and now it.s taken off. In addition to graphic and web design (which she.s been doing since 2004), now her company also offers business writing consultation and creative coaching services. EA sure can write. I remember coming back to Victoria in 2007 and looking for a job with my crappy resume. She redid it and the phone started ringing right away.

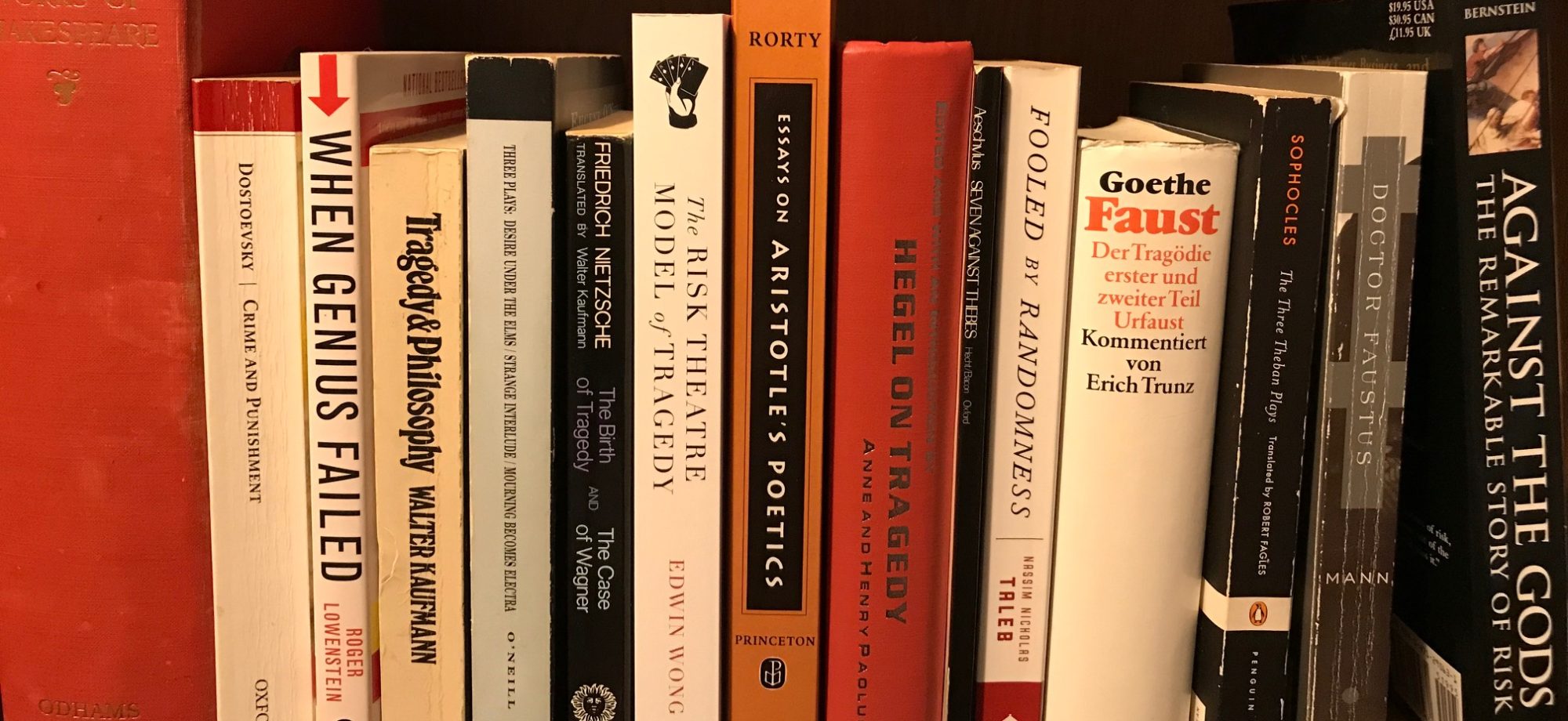

While we were catching up, I mentioned that the income coming in from stocks and bonds was one of the reasons why I was able to switch over to Doing Melpomene’s Work full-time. She.d been thinking about setting up some investments to get the passive income stream started. I promised to share with her the tips I.ve picked up over years. Since investing interests me just about as much as theatre (they both revolve around risk and uncertainty), I thought I.d type out my thoughts into words on the blog. Hopefully other diligent readers will be able to benefit as well. To me, investing = empowering yourself to do what you want. If you spend money, it.s gone. If you invest money, the money works for you. The more money you have invested, the more time you have to do the things you want and love to do. It.s that simple. Sort of.

What You Can Expect (and not expect) from Investments

1. Do not expect to get rich from investments. If you want to get rich, startup your own company. Stocks and bonds are good places, however, to park your money. Bill Gates is a good example. He didn.t become the world.s richest person through stocks. He did it through starting up Microsoft. But once he had money, he put it to work in the stock market.

2. Do expect to be able to draw 3-4% income stream from your investments each year. If you.re younger, the number is closer to 3%. If you.re older, the number is closer to 4%. The reason that the drawdown ratio is less when you.re younger is because when you.re younger, your portfolio has to survive more down years. If the stock market experiences a couple of down years in a row (very likely over a long time horizon), the less you draw, the easier it recovers during the good years.

3. Do not expect big results right away. Investing is a long term thing. And it.s hard to think different about money. For every $1000 we invest, we are confronted with the opportunity cost of not being able to spend it (because it.s locked away in the investment). So we feel the pain of not having the vacation or not buying the big screen TV. So, if we can draw 3% each year from the investment, it means for each $1000, we can either have the satisfaction of $30/year every year or the satisfaction of the new big screen TV right now. The satisfaction of having the TV today seems better. I mean, really, what.s $30?–that.s a couple of cups of coffee and a Big Mac! But…

I.ve been investing for 25 years. All the consumer stuff I could have bought back then would likely be in the garbage today where it has zero, zilch, nada value. The money that I socked away still has value, and, since it has grown, has an even greater value today. So, yes, there.s an opportunity cost in investing. But think of how investing and the passive income stream can help you in the future. Future means at least 5 to 10 years from today.

A couple of years or so after I started out (over twenty years ago), I had been trying to spread the investing gospel to my friends. A lot of us were big spenders. I remember trying to talk about the merits of saving. One comment I.ll always remember. One night me and CM were chatting about how much the income stream was. When we worked it out, he said, ‘What!?! You saved all that so that you could get a squeegee each month?’. Undeterred, I stuck it out. And yes, the passive income stream produces much more than a squeegee each month now.

4. Do plan to gradually replace monthly expenses with your new passive income stream after you.ve been investing five or so years. Gradual is the key word. You.re not going to be able to replace the whole salary from the 9-5 job all at once. If you like coffee shop coffee and it costs you $50 a month, aim to save up enough to pay for all your coffees with the passive income stream (at a 3% drawdown rate you would need $20,000 invested).

5. Do realize that investing will change the way you look at money for the better. For example, if you realize that you have to invest $20,000 to be able to drink $50 of coffee shop coffee each month, you might just decide to trim expenses. Investing makes you aware of how valuable money actually is.

In fact, I don.t look at the face value of money anymore. The common way of looking at money is from the point of view of a spender. If someone had $100,000 dollars, he would likely think, ‘I.m rich, I could buy a Porsche 911 or that big yacht’. Money to average person = consumer goods. That.s the way we.ve been brought up in the consumer society. If I had $100,000 in my hand right now, I would look at it as an income stream of $3000 each year for the rest of my life. The $100,000 doesn.t really make me ‘richer’. But the $3000 income stream gives me more freedom to be doing whatever it is that I love doing. The investor.s perspective is different than the consumer perspective.

Different Things You Can Do in the Stock Market

There.s a lot of different ways to invest. You can play the stock market like a casino: go big or go home. Venture capital, micro-cap heart attack stocks. That.s not what I do. You can time the market: buy low and sell high. That.s harder than it seems. That.s not what I do. You can try your hand at momentum investing: buy the hot sector and ride it to the top! That sounds exciting but that.s not what I do. You can practise value investing: buying stocks on the fundamentals. If I were to do something besides what I.m doing, this would be it. But that.s not what I do. If you have connections, you can try insider trading. Like Gordon Gekko in the 1987 film Wall Street. But that.s not what I do, although if you gave me a sweet brickphone I just might try.

Well what do I do? Because the point is to create a passive income stream, I invest with income in mind. That is to say: find stocks or baskets of stocks that pay dividends. There.s two ways to make money in the stock market: capital gains or dividends. Capital gains result when the stock goes up in value. Dividends are the income that you receive because you are a part-owner of a profitable company.

A stock market is sort of like an investment property. If you buy a second house, it goes up in value, and you sell it, the proceeds from the sale is like a capital gain. If you buy a second house and you rent it, the rental income is like the dividend that a stock pays. Since I don.t really intent to sell, capital gains don.t really mean much to me. It.s like if you had a second house: would you really get it appraised every day? Or, if you.re after the income stream, would you just sit back and be content to collect the rent without worrying about daily fluctuations in your house.s price? My intent is not to sell, since I.m happy with my investments and if I were to sell, I.d just have to invest it into something else.

In this entry, I.ve discussed the benefits you can enjoy from having a passive income stream. Also, I.ve gone over some things to expect and not expect. This is no get rich quick scheme but a methodical lifelong process. Finally, I.ve touched upon my investment philosophy. Stay tuned for the next instalments where I.ll provide real life examples of how my DIY investments are set up. Costs are critical in investing and DIY is the way to go. And, believe it or not, DIY can be incredibly simple, empowering, and rewarding!

Until next time, I.m Edwin Wong, and these are some of the secrets of how I.m able to be Doing Melpomene’s Work.

Pingback: Passive Income Part Two - Costs - Doing Melpomene's Work

Pingback: Passive Income Part Four - Accounts - Doing Melpomene's Work

Pingback: Passive Income Part Six - FAQ and Philosophy - Doing Melpomene's Work