2019, Vintage, 288 pages

Giridharadas defines MarketWorld as “an ascendant power elite that is defined by the concurrent drives to do well and do good, to change the world while also profiting from the status quo.” He has a beef with MarketWorld because of its inherent contradiction. In Winners Take All, Giridharadas points out the irony of how MarketWorlders donate money to rehab programs after raking in profits selling opioids (Purdue Pharma). Other examples include how MarketWorlders who own companies that target African Americans with more addictive menthol cigarettes give grants to help African Americans eat healthier in Harlem (Loews Corporation). Winners Take All is written as a tell-all exposé revealing the dark side of philanthropy all the way from Andrew Carnegie in the late nineteenth century to The Clinton Global Initiative and The Bill and Melinda Gates Foundation today.

The problem, according to Giridharadas, is that MarketWorlders become who they are by exploiting the masses. They harness the inequalities in the system to become the power brokers. And then they donate money to the causes that they support. They target a social and economic issue such as poverty, for example. But they never target the inequality itself that lies at the root of poverty. And that, writes, Giridharadas, is the heart of the contradiction: MarketWorlders create the problem, then ease their conscience by writing a cheque. Philanthropy in that guise is a sham. Today’s philanthropists donate, but they preserve the status quo that makes such donations necessary. Without the status quo, they wouldn’t have become rich. The rich have a blindspot when it comes to inequality. To illustrate his point, Giridharadas begins his book Winners Take All with a memorable epigram by Tolstoy:

I sit on a man’s back choking him and making him carry me, and yet assure myself and others that I am sorry for him and wish to lighten his load by all means possible . . . except by getting off his back.

Solution One: Increase Taxes on the Wealthy

Because the rich will not address inequality, another group has to step up. Giridharadas proposes that the government is well suited for this task. The government, by increasing taxes on corporations and the wealthy, can fund a greater array of social programs to alleviate inequality.

Although not mentioned by Giridharadas, one such program that would have wide support from both sides of the political spectrum, from 2020 Democratic presidential candidate Andrew Yang to economist Milton Friedman–the architect of Reaganomics–is a universal basic income program. Such a program would simplify government and do away with the stigma of receiving welfare, employment insurance, and many other government programs by doing away with income-tested benefits by providing an automated and perpetual income stream to each citizen irregardless of wealth or need. Universal basic income appeals to the right because it simplifies government, makes government smaller by rolling welfare, employment insurance, disability benefits, etc., into one program. And universal basic income appeals to the left because it satisfies the left’s mandate for government to look after people.

In Canada, many people during the Covid-19 pandemic have come to rely on the Canada Emergency Response Benefit (CERB) payments. In the dialogue on what happens when the CERB program ends, some people have suggested instituting a universal basic income program. We will see.

Solution Two: Change Corporate Structures

Corporations exist for one purpose, and that purpose is to maximize shareholder value. “Greed is good,” runs the corporate mantra. If a company tries to place “doing good” ahead of “creating shareholder value,” shareholders will revolt and replace the board of directors. As Harvard business school professor Michael Porter and Mark Kramer wrote in a seminal 2011 essay: “Creating Shared Value,” companies overlook the long-term good by maximizing shareholder value in day to day and quarter to quarter operations. What if a new type of corporation could be created, one where “doing good” was built into its charter along with “maximizing shareholder value?”

After working years in private equity, this is what Andrew Kassoy did: he came up with and enacted a plan to reform corporate structure. He devised a framework to convert existing companies or for startups to structure themselves as “B corps” or “benefit corporations.” B corps would pursue a dual mandate to enrich shareholders and pursue good. Notable B corps today include Kickstarter, King Arthur Flour, Ben & Jerry’s, Patagonia, and Natura.

The largest B corp is the publicly traded education company Laureate Education with over 150 campuses in ten countries. It started trading on the Nasdaq in February 1, 2017 at $14 per share. Three and a half years later, it’s trading at $13.81, down 1.35%. I compared Laureate Education (LAUR) to other conventional (e.g. standard, not B corp) education companies trading on the Nasdaq. Perdoceo Education (PRDO) was at $9.78 February 1, 2017. Today it’s at $11.81, up 20.76%. Lincoln Education (LINC) was at $1.96 February 1, 2017. Today it’s at $5.34, up 176%. K12 (LRN) was at $19.53 February 1, 2017. Today it’s at $28.93, up 48.13%. Finally, America Public Education (APEI) was at $24.40 February 1, 2017. Today it’s at $28.84, up 18.2%. The difference in performance between the B corp Laureate Education and the others must be the inferred cost of “doing good.” The question, as always, is: “Do you invest in Laureate and let their board decide what is good or do you invest in the others and take the profit to use on what you yourself decide is good?” You cannot have your cake and eat it too: either you let Laureate do good at the cost of your return on investment or you invest in the other, more mercenary companies which will enrich you at others’ expense.

Solution Three: Ask the People You are Helping for Feedback

It’s ironic, writes Giridharadas, how the elites change the lives of those who need help without ever consulting them. The elites–who hail from the ivory towers and the gilded halls of private equity–look at social issues as corporate or academic issues: have a meeting, break down the problem into discrete quanta, insert each of these quanta into a PowerPoint presentation, put in into a chart, a graph, and connect the points. But, the greatest problems of our age are human concerns. Instead of turning the oppressed and the downtrodden and the unfortunate into a statistic and foisting your preconceived notion of what is good onto them, why not ask them what they want, ask them if they have ideas of how to better their world? If your goal is to help a village in Mongolia, it might be a good idea to do some ground reconnaissance in addition to your closed-door PowerPoint presentation.

This seems like a good point. Who knows the unintended consequences of bringing Western reforms to the far corners of the globe? I wish Giridharadas had taken his own advice in Winners Take All. He interviews many people and presents many points of view in the book. Unfortunately, all the critiques of capitalism he cites comes from CEOs, former presidents of the United States of America, private equity barons, and TED talks thought leaders. What does the street vendor in Vietnam think of inequality? What about the Mongolian miner working at the Rio Tinto copper mine? We don’t know. This not knowing the view from the ground brings me to my closing point: what are the roots of inequality?

The Roots of Inequality?

If you ask the power brokers in First World countries where poverty comes from, they will tell you that poverty arises from inequality. It started with Adam Smith’s economics. He told the butcher, the brewer, and the baker that self-interest makes the world go around. From Adam Smith to today’s corporations a line can be drawn: Smith’s self-interest has become the corporations “greed is good” mantra. As a result, some became rich and others became poor. The results are disastrous, they will say. And they will quote statistics that are hard to argue against, statistics such as how the top ten percent of people own ninety percent of the world’s wealth. Capitalism is the problem, the power brokers will say. And that is what they do say in Giridharadas’ book. Capitalism allows the few to get rich off the backs of the many.

Now, if you ask the less well to do folks in First World countries why they live in poverty, they might, to judge from movement such as Occupy Wall Street, say something similar. Capitalism favours the rich, who get rich by exploiting the poor. The rich, in turn, through lobbying and donations to political parties, fandangle new ways to avoid paying taxes and nurturing the society that made wealth possible.

Now, if you ask the less well to do folks in Third World countries why they live in poverty, they just might have something different to say than the folks in First World countries. Judging from the vitality, dynamism, and energy in the hustling and bustling markets emerging in Vietnam, China, Poland, and Hungary, less well to do folks in Third World countries may be welcoming capitalism’s market reforms. Their response may be the opposite to that of their counterparts in developed countries.

This is one of the reasons I was hoping that Giridharadas would have asked the people burdened by inequality all over the world for their feedback. I conjecture that First World folks are quick to blame inequality. And I conjecture that Third World folks are less likely to blame inequality. My question, and one that is valid, in my mind is this: is capitalism a First World problem? My gut tells me many folks outside the First World would actually welcome capitalism. Why this divide?

What is Inequality?

My closing question is this, and I don’t think it’s a question that’s easy to answer. There are so many variables involved, the question is probably best thought of as a thought experiment. My question is this: is inequality an artifact of capitalism, or is inequality something else, a natural, sociological phenomenon?

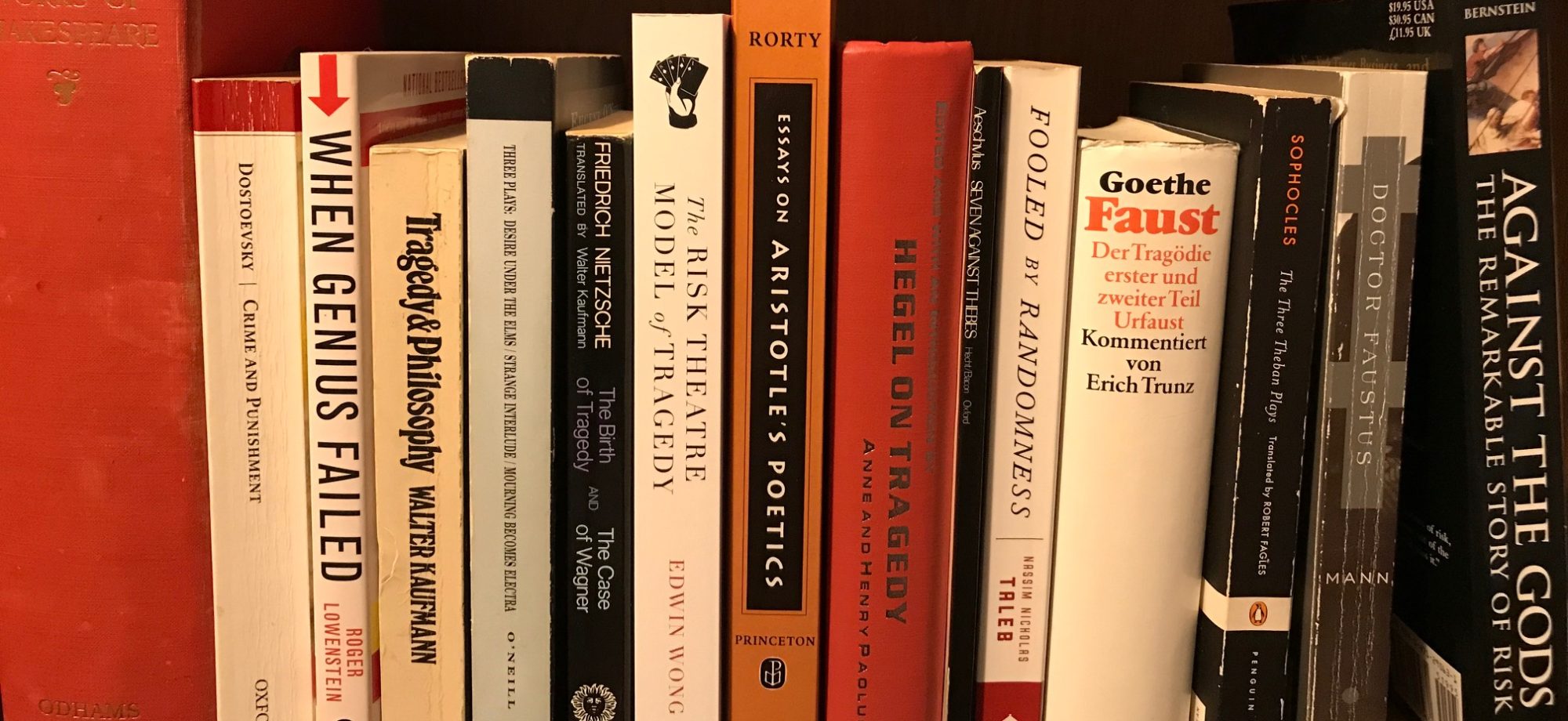

For a second, let’s turn away from the financial marketplace. Let’s look at book sales, something that has attracted my attention since publishing a book last year. Each year, over three million books are released globally. Most of these three million books will sell a few hundred copies. Some will sell thousands and tens of thousands. But the book market, despite being made up of millions of books, will be dominated by a few best-sellers. Think Stephen King, Margaret Atwood, and Dan Brown. In fact, the top 10% of best-sellers will be responsible for 85% of all books sold. If we extend this slightly, the top 20% of best-sellers will have captured nearly the entire book market, being responsible for 95% of the world’s book sales. Talk about inequality! But does anyone complain about the inequality of the book market? I think most people accept this as the way things are.

Did the distribution of book sales–the top 10% of the sellers own 85% of the market–remind you of another distribution I mentioned earlier in this blog? Earlier, citing Giridharadas, I wrote that the wealthiest 10% own 90% of the world’s wealth. In the markets, it appears a few winners take all. So too, in the book market, it appears a few winners take all. Is there a relation between the book and stock markets?

The Power Law Distribution

Although consumers believe they exercise autonomy in purchasing books, an emergent phenomenon can be seen if you plot book sales on a double logarithmic graph with the x-axis representing the sales rank (with each unit increasing in powers of 10, e.g. 1, 10, 100, 1000, etc.,) and the y-axis representing sales volume (again, with each vertical unit increasing in powers of 10, e.g. 1, 10, 100, 1000, etc.,). When sales rank and sales volume are plotted on a double logarithmic graph, a straight lines forms, descending on roughly a 45-degree angle from the top left to the bottom right of the chart.

Emergent phenomena are some of the coolest things. They are phenomena that appear on large scales, but not on small scales. The flight of starlings or the motions of schooling fish are emergent phenomena: like book buyers, they make individual decisions but the sum of their individual decisions can be modelled. When we see emergent phenomena, we see in social, economic, and natural systems a greater power at work, an invisible hand creating order from chaos.

If you plot on a log-log graph the number of people against their wealth, you will find that the miraculous happens: the data points will form a straight line with a similar slope to the book sales graph. Wealth–or inequality–obeys a power law distribution. What this says is that inequality is a natural phenomenon like all the other distributions that obey a power law. Besides book sales and income, the size of cities, the power of earthquakes, and the frequency academic papers are cited all obey power law distributions.

The power law hints at powerful forces shaping the quantities it measures. To determine the hidden mechanisms guiding the power law’s invisible hand, we have to conjecture. With book sales, for example, we can conjecture that the winning authors take all because of the influence of big publishers, word of mouth, the action of book clubs, the ability of social media to scale sales, the concentrating effect of bestseller lists, and so on.

Something similar can be done for income. We can conjecture, for example, a base point where people start off at similar incomes and wealth. By the action of chance, some will make more than others. Then we can add more variables: the ones with more can invest more, increasing their wealth at a faster proportion than those with less wealth. And perhaps those with minor wealth will choose to invest their money with a handful of winners, increasing the wealth of the handful of winners in much the same way as book buyers congregate towards a few best-selling titles. Then sooner or later, in this thought experiment, you end up with an income distribution that approximates that of the real world. Note that in this thought experiment, capitalism and inequality are not necessary hypotheses. The only necessary hypothesis is that, by random chance some will become wealthier.

In this view, capitalism and the markets are not responsible for inequality. In any given society–socialist, capitalist, communist, and agrarian, from the Bronze Age through to ancient Rome, the Industrial Revolution, up to modern times–the action of chance and the snowballing effect of social networks will create a winner take all distribution in wealth. You can redistribute the wealth through revolution or taxation, but you only reset the system for a duration: inequality, like the force of earthquakes and the size of cities, is a natural law built into the structure of society, any society. The moment the system is reformed, it starts working itself back into a critical state in a new guise.

The elites ascribe their position and wealth to superior intelligence and work ethic. The poor ascribe their position to the erosive power of capitalism and inequality. They are both fooled by randomness. If we can observe, from ancient to modern times, the distribution of income following a power law, then inequality is nature’s will. And how do you rebel against natural law? In ancient Rome, the Gracchi thought they had the answers. In revolutionary France, Robespierre thought he had the answers. Today, Thomas Piketty proposes his answers. But what is the answer? The answer, Giridharadas, is blowing in the wind.

– – –

Don’t forget me. I’m Edwin Wong, and I do Melpomene’s work.